From Quartz:

According to a new report from Citi’s research division, people in China are actually using fintech products. The three biggest internet companies—Baidu, Alibaba, and Tencent—all have digital finance businesses that are thriving. Baidu Wallet has 45 million users. Alibaba’s Alipay is the world largest fintech startup and processed almost $2.6 trillion in payments in 2015—a third of all third-party transactions in China. Tencent’s financial products accounted for $800 billion in payments in 2015.

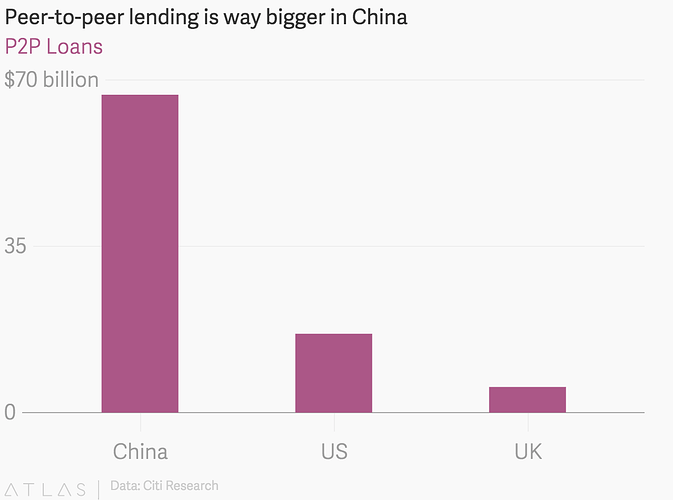

China’s fintech dominance isn’t just in payments. Alternative and peer-to-peer lending is bigger as well. The US does more peer-to-peer lending than the UK, but, combined, the two countries do less than China.

From an ecosystem building perspective, it’s important to recognise a key factor. This is a result of the market being ready to adopt the technology.

I’d expect that if we zoomed into the adoption data, we’d see pockets of technology early-adopter markets, similar to how San Fransiscans and Kenyans are more likely to try new technology than others on their continent. ( @Uniquejosh Care to comment on patterns in payment/tech adoption here?)

This is an example of the Apex model, where the strengths of the local ecosystem have provided bigger upside than focusing on traditional definitions or leaders of FinTech. Based on the lens investors through which investors view ecosystems, the Fintech capital of the world would be New York, London or San Francisco. We see here though, that the real growth is outside of that perspective.